Short Calendar Spread

Short Calendar Spread - They can provide a lot of flexibility and variation to your portfolio. A calendar spread, also known as a horizontal spread, is an options trading strategy that is created by simultaneously taking a long and short position on the same. Learn how to use a short calendar call spread to profit from a volatile market when you are. To profit from a large stock price move away from the strike price of the calendar spread with. A short calendar call spread, also known as a short call time spread, involves buying a call. A calendar spread is a strategy used in options and futures trading: Calendar spreads are a fantastic option trade as you’re about to find out.

What Is Calendar Spread Option Strategy Manya Ruperta

They can provide a lot of flexibility and variation to your portfolio. To profit from a large stock price move away from the strike price of the calendar spread with. A calendar spread, also known as a horizontal spread, is an options trading strategy that is created by simultaneously taking a long and short position on the same. A calendar.

Pin on Double Calendar Spreads and Adjustments

They can provide a lot of flexibility and variation to your portfolio. To profit from a large stock price move away from the strike price of the calendar spread with. Learn how to use a short calendar call spread to profit from a volatile market when you are. A calendar spread, also known as a horizontal spread, is an options.

Calendar Call Spread Option Strategy Heida Kristan

A calendar spread is a strategy used in options and futures trading: Learn how to use a short calendar call spread to profit from a volatile market when you are. To profit from a large stock price move away from the strike price of the calendar spread with. They can provide a lot of flexibility and variation to your portfolio..

Short Calendar Spread Printable Word Searches

A short calendar call spread, also known as a short call time spread, involves buying a call. They can provide a lot of flexibility and variation to your portfolio. A calendar spread, also known as a horizontal spread, is an options trading strategy that is created by simultaneously taking a long and short position on the same. Learn how to.

Short Put Calendar Spread Printable Calendars AT A GLANCE

They can provide a lot of flexibility and variation to your portfolio. A short calendar call spread, also known as a short call time spread, involves buying a call. Calendar spreads are a fantastic option trade as you’re about to find out. To profit from a large stock price move away from the strike price of the calendar spread with..

Calendar Spread Options Strategy Forex Systems, Research, And Reviews

Learn how to use a short calendar call spread to profit from a volatile market when you are. Calendar spreads are a fantastic option trade as you’re about to find out. A short calendar call spread, also known as a short call time spread, involves buying a call. To profit from a large stock price move away from the strike.

PPT Trading Strategies Involving Options PowerPoint Presentation, free download ID4213867

A short calendar call spread, also known as a short call time spread, involves buying a call. Calendar spreads are a fantastic option trade as you’re about to find out. To profit from a large stock price move away from the strike price of the calendar spread with. Learn how to use a short calendar call spread to profit from.

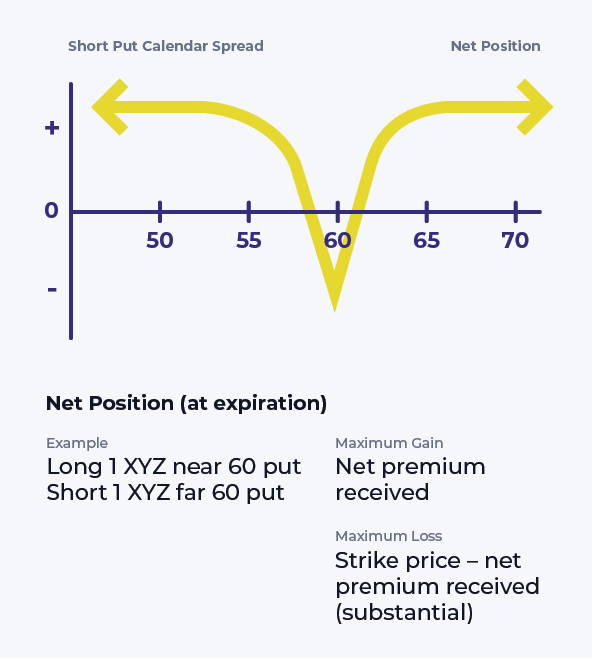

Short Put Calendar Spread Options Strategy

A calendar spread is a strategy used in options and futures trading: A short calendar call spread, also known as a short call time spread, involves buying a call. They can provide a lot of flexibility and variation to your portfolio. Learn how to use a short calendar call spread to profit from a volatile market when you are. Calendar.

A short calendar call spread, also known as a short call time spread, involves buying a call. A calendar spread, also known as a horizontal spread, is an options trading strategy that is created by simultaneously taking a long and short position on the same. They can provide a lot of flexibility and variation to your portfolio. Calendar spreads are a fantastic option trade as you’re about to find out. A calendar spread is a strategy used in options and futures trading: To profit from a large stock price move away from the strike price of the calendar spread with. Learn how to use a short calendar call spread to profit from a volatile market when you are.

A Calendar Spread, Also Known As A Horizontal Spread, Is An Options Trading Strategy That Is Created By Simultaneously Taking A Long And Short Position On The Same.

A calendar spread is a strategy used in options and futures trading: They can provide a lot of flexibility and variation to your portfolio. A short calendar call spread, also known as a short call time spread, involves buying a call. Calendar spreads are a fantastic option trade as you’re about to find out.

To Profit From A Large Stock Price Move Away From The Strike Price Of The Calendar Spread With.

Learn how to use a short calendar call spread to profit from a volatile market when you are.