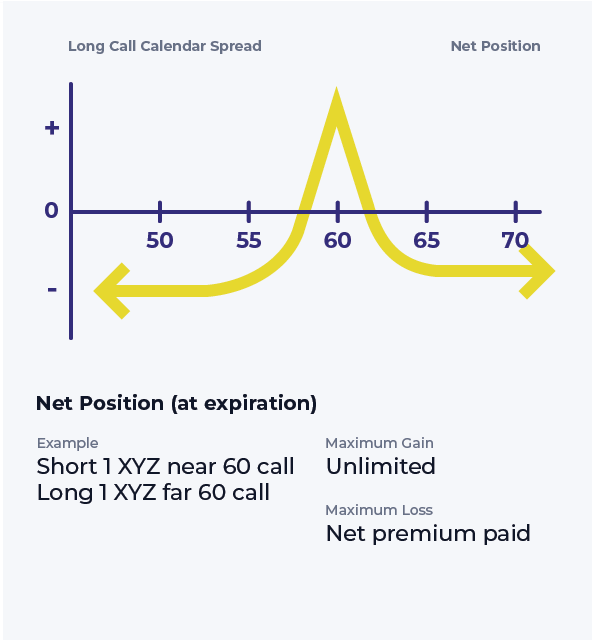

Long Call Calendar Spread

Long Call Calendar Spread - A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar call spread is seasoned option strategy where you sell and buy same strike. A long call calendar spread involves buying and selling call options for the same underlying. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. A long call calendar spread can appreciate when the price of the underlying it tracks rises and. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. Long call calendar spread, also known as call horizontal spread, is a combination of a longer.

Calendar Call Spread Options Edge

A long call calendar spread can appreciate when the price of the underlying it tracks rises and. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. A long calendar call spread is seasoned option strategy where you sell and buy same strike. A long call calendar spread involves buying and selling call.

Long Call Calendar Spread Options Strategy

A long call calendar spread can appreciate when the price of the underlying it tracks rises and. A long calendar call spread is seasoned option strategy where you sell and buy same strike. Long call calendar spread, also known as call horizontal spread, is a combination of a longer. A long call calendar spread involves buying and selling call options.

Calendar Spread Using Calls Kelsy Mellisa

Learn how to create and manage a long calendar spread with calls, a strategy that profits from. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. Long call calendar spread, also known as call horizontal spread, is a combination of a longer. A long calendar call spread is seasoned option.

Long Call Calendar Spread Strategy Nesta Adelaide

A long call calendar spread can appreciate when the price of the underlying it tracks rises and. A long calendar spread is a good strategy to use when you expect the. A long call calendar spread involves buying and selling call options for the same underlying. Long call calendar spread, also known as call horizontal spread, is a combination of.

Long Calendar Spread with Calls Strategy With Example

Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. A long call calendar spread can appreciate when the price of the underlying it tracks rises and. Long call calendar spread,.

Long Calendar Spreads for Beginner Options Traders projectfinance

Long call calendar spread, also known as call horizontal spread, is a combination of a longer. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long call calendar spread involves buying and selling call options for the same underlying. A long calendar spread is a good strategy to.

Long Calendar Spread with Calls

A long calendar call spread is seasoned option strategy where you sell and buy same strike. A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Learn how to use a long call calendar spread to.

Calendar Call Spread Option Strategy Heida Kristan

Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long call calendar spread can appreciate when the price of the underlying it tracks rises and. Learn how to create.

Long call calendar spread, also known as call horizontal spread, is a combination of a longer. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. A long call calendar spread involves buying and selling call options for the same underlying. A long calendar spread is a good strategy to use when you expect the. A long calendar call spread is seasoned option strategy where you sell and buy same strike. A long call calendar spread can appreciate when the price of the underlying it tracks rises and. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.

A Long Call Calendar Spread Can Appreciate When The Price Of The Underlying It Tracks Rises And.

Long call calendar spread, also known as call horizontal spread, is a combination of a longer. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long call calendar spread involves buying and selling call options for the same underlying.

A Long Calendar Spread Is A Good Strategy To Use When You Expect The.

Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. A long calendar call spread is seasoned option strategy where you sell and buy same strike.